In Part 1 of this Blog series, we looked at the cash flows of basic investments like stocks and bonds. In this series, we will look at the cash flows from the other end, the actual capital investments.

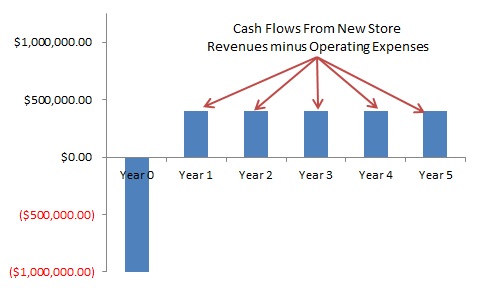

While we generally think of stocks and bonds as “investments,” stocks and bonds really just funnel money through to the physical capital investment. The returns from this capital investment ultimately pay the interest to bondholders or pay the dividends or price appreciation to stockholders. To see how this works, imagine the prototypical capital investment of a retailer opening a new store. Cash goes out to build the store and cash comes back in through the store’s revenues minus its operating costs. Some of the cash coming in has to go to interest costs and the rest goes to shareholders through one of the three methods above.

There is actually a big debate surrounding whether a company’s managers and consequently its employees should work exclusively to increase “shareholder value” or if shareholders have tasked managers with more objectives than simply increasing the stock price. I will not weigh in on the debate here, but safe to say that generally shareholders like to see higher returns, all other things equal. Also, shareholders already seeing 10% returns would not want new stock to be issued to fund a project which earns 1% returns. The existing 10% returns would be “diluted,” or go to the new stock as well as the old stock. Existing shareholders would now see returns lower than 10%. For this reason, a company’s CFO may set a “hurdle rate” which specifies the rate of return necessary to fund a project. Any project above this hurdle rate should safely increase the returns the shareholders are already receiving.

Two Types of Cash Flows: Revenues and Avoided Costs

The simplest, MBA case study version of valuing a capital investment is something like the retailer’s expansion above. The real estate group of the retailer will estimate the costs of designing and building a new store. Then, based on local demographics, economic trends, and other measures, the real estate group will also estimate the cash inflows from the store after opening. One key difference is that, unlike bonds or stocks, there is no big principal payment at the end of the investment. There is only the equivalent of interest through operating revenues.

Perhaps the biggest issue in understanding payback from ECM’s is the concept of avoided costs. No energy-consuming client is in the business of reducing their energy costs. Their business is whatever drives their revenues, not their costs. The cash from avoided costs, however, is no less real than the cash from increased revenues. Whether a project drives increased cash flows through the top line down (revenue) or straight to the bottom line (avoided costs), each project must be treated equally. In the next blog post, we will look at some differences in valuing avoided costs versus valuing revenues.

Coming in a few weeks – Part 3: Avoided Costs and ECM’s